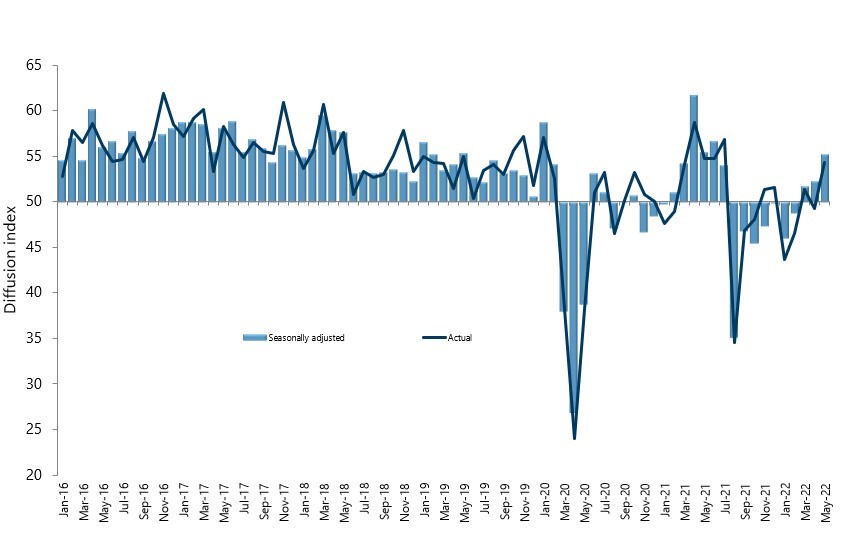

Activity levels in New Zealand’s services sector displayed upwards momentum during May, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

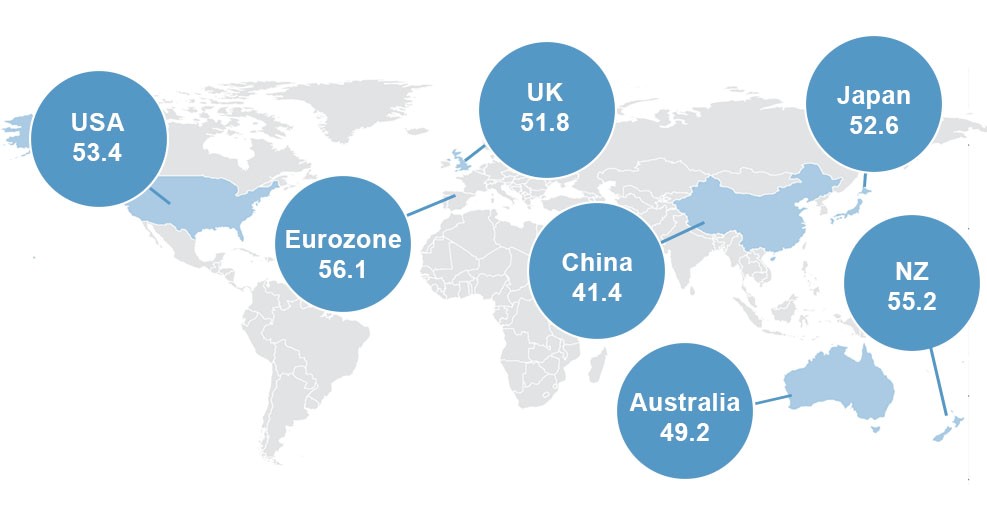

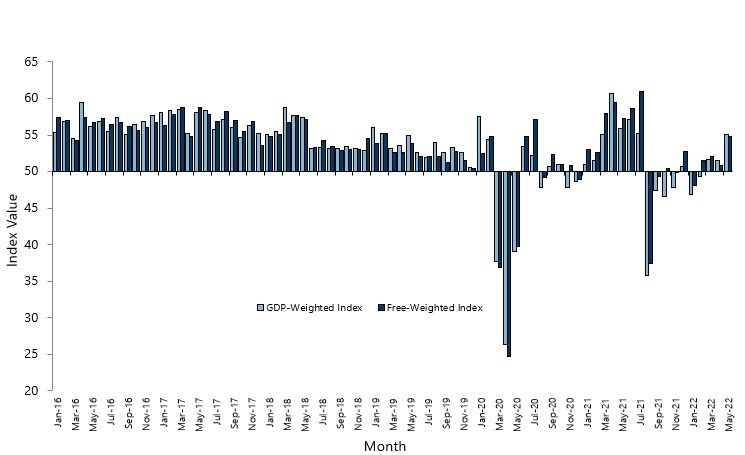

The PSI for May was 55.2 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was up 3 points from April, and above the long-term average of 53.6 for the survey.

BusinessNZ chief executive Kirk Hope said that the May result represented the highest monthly result since June 2021, and the fourth consecutive time showing increased activity from the previous month. Obviously, any rush to conclude the sector is now firmly back on track needs to be tempered with the fact that there are still a number of potential headwinds coming, both domestically and internationally.

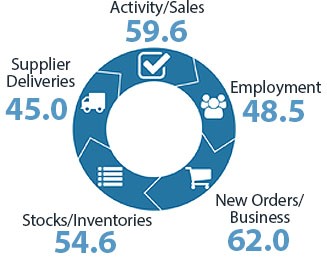

“The two key sub-indexes of New Orders/Business (62.0) and Activity/Sales (59.6) both experienced a healthy pick-up in activity to lead the way in overall expansion. While Employment (48.5) went back into contraction during May, Supplier Deliveries (45.0) recovered somewhat from earlier lows.”

With the pick-up in expansion, the proportion of negative and positive comments were exactly even for May, compared with 61.9% of negative comments in April.

BNZ Senior Economist Doug Steel said that “while the improvement was far from universal across components, reflecting many ongoing challenges across segments of the service sector, the overall outcome was the first above average result since the outbreak of Delta in August last year.”