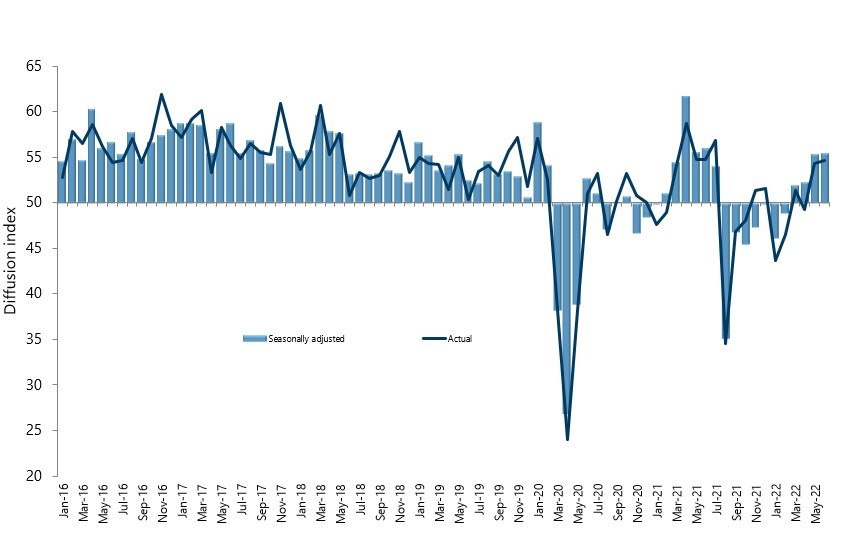

Activity levels for New Zealand’s services sector in June displayed almost identical levels to last month, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

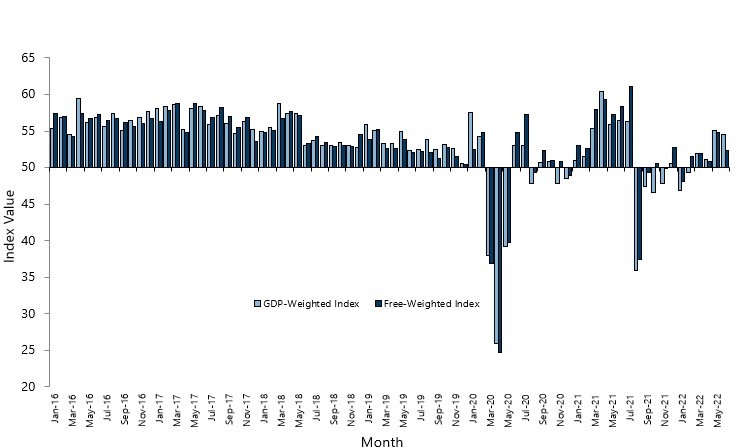

The PSI for June was 55.4 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was up 0.1 point from May, and above the long-term average of 53.6 for the survey.

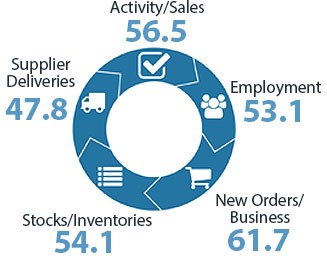

BusinessNZ chief executive Kirk Hope said that it was pleasing to see two consecutive months of healthy activity in the sector. The fact that the two key sub-indexes of New Orders/Business (61.7) and Activity/Sales (56.5) remained at very healthy levels of expansion has more than compensated with other issues at play, such as supplier deliveries (47.8) still stuck in contraction.

Despite the consistent level of expansion with the previous month, the proportion of negative comments rose to 59% in June, compared with 50% in May and 61.9% in April.

BNZ Senior Economist Craig Ebert said that “the move to traffic light Orange in mid-April, along with the expedited opening of the border, is clearly providing a basis for sustained improvement in New Zealand’s services sector”.