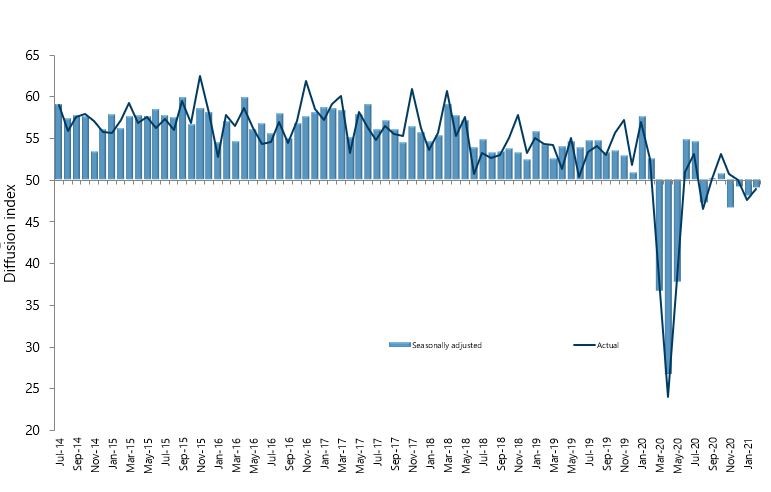

Activity in New Zealand’s services sector remained in contraction for a fourth consecutive month, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for February was 49.1, which was up 1.1 points from January (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). However, it was still well below the long term average of 53.8 for the survey.

BusinessNZ chief executive Kirk Hope said that while the slight pick-up in activity to levels seen in December was obviously a positive step, the sector remains below the critical 50.0 mark. The last time the sector was in contraction for four consecutive months was the first half of 2009.

“The slower return to business as usual post holidays was compounded by the two separate lockdown periods in mid and late February, with Auckland hit hardest. This has meant the key sub-indices of Activity/Sales (50.8) and New Orders/Business (50.3) were both lethargic over February.”

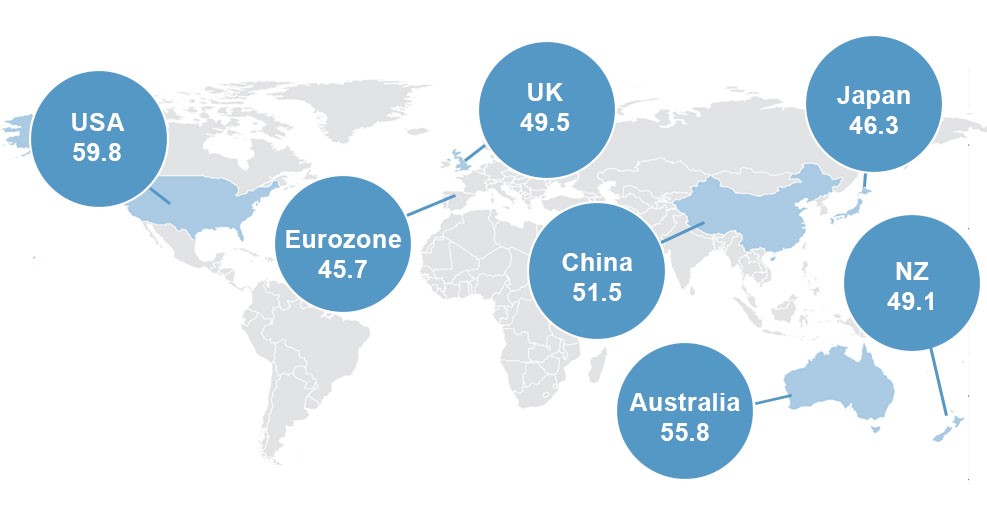

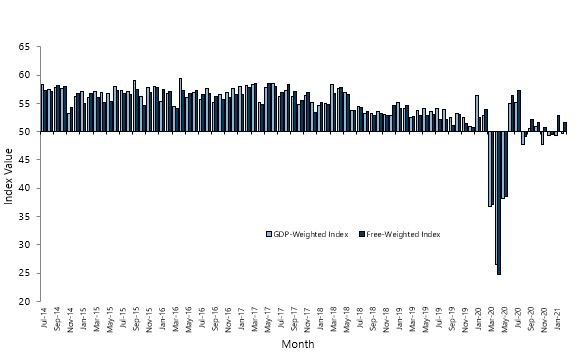

BNZ Senior Economist Craig Ebert said that “when simply averaging across all responses to the PSI and PMI surveys gives a composite reading of 51.6 for February. But re-weighting for the fact services comprise around 70% of the economy and the composite index yields 49.7. With this, we remain decidedly cautious on GDP growth for Q1.”