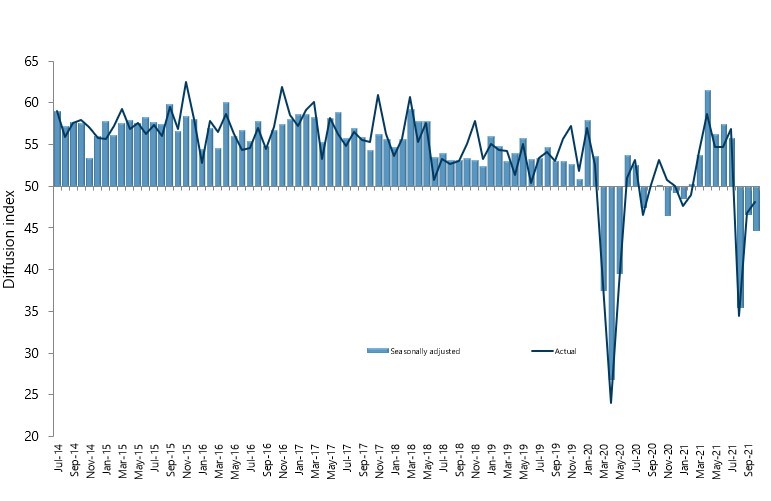

New Zealand’s services sector stepped further into contraction during October, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

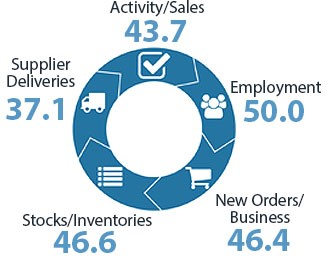

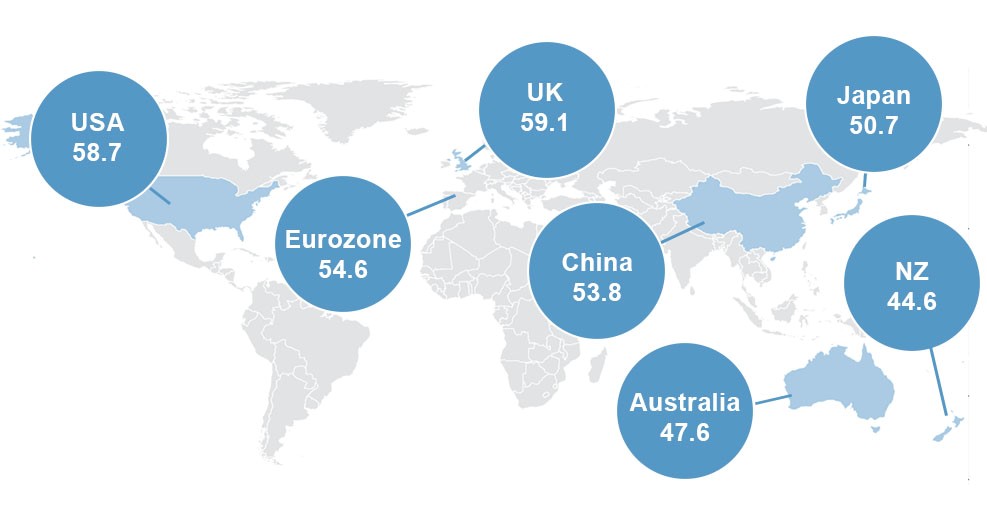

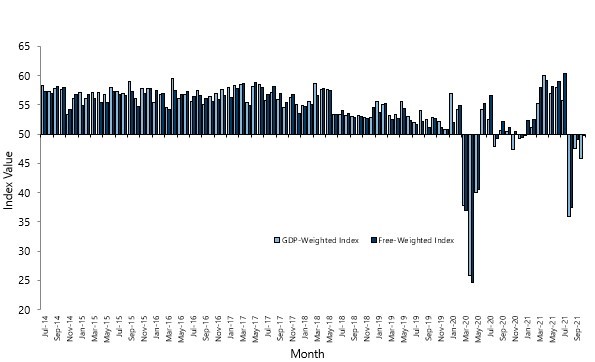

The PSI for October was 44.6 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was down 1.9 points from September, reversing some of the 11.1 point increase from August to September.

BusinessNZ chief executive Kirk Hope said that it was disappointing that the gains in September did not also flow through to October.

“The key sub-indexes of Activity/Sales (43.7) and New Orders/Business (46.4) still clearly remain in contraction, while Employment (50.0) remains unchanged. With Auckland taking another recent step towards opening up, this will hopefully provide greater ability for a number of service sector businesses in New Zealand’s largest city to lift their activity levels and prepare more fully for the Xmas period ahead.”

BNZ Senior Economist Doug Steel said that “the ongoing weakness in services overall – in contrast to the improvement we saw in last week’s Performance of Manufacturing Index – fits with our thinking that any bounce in Q4 GDP will be modest, especially in comparison to the decline in Q3.”