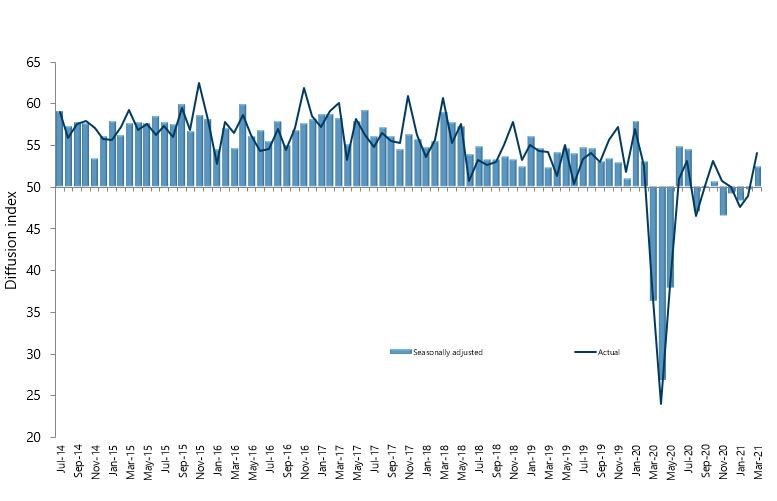

Activity in New Zealand’s services sector climbed into expansion during March for the first time in five months, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for March was 52.4, which was up 2.7 points from February (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was the highest result since July 2020, although still below the long term average of 53.8.

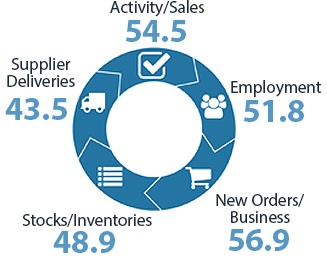

BusinessNZ chief executive Kirk Hope said that a lift in the key sub-index of New Orders/Business (56.9) led the way towards expansion in March, followed by Activity/Sales (54.5). The other three sub-indices continue to show either lacklustre expansion or remain in contraction.

“Any sustained shift towards the services sector exhibiting ongoing expansion will need to see activity/sales and new orders remaining near or above their long term average results to continue momentum”.

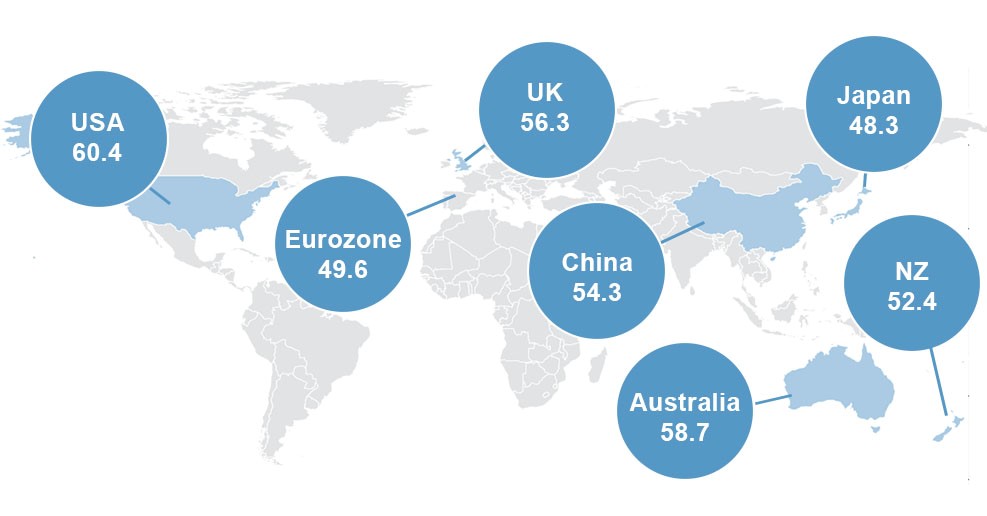

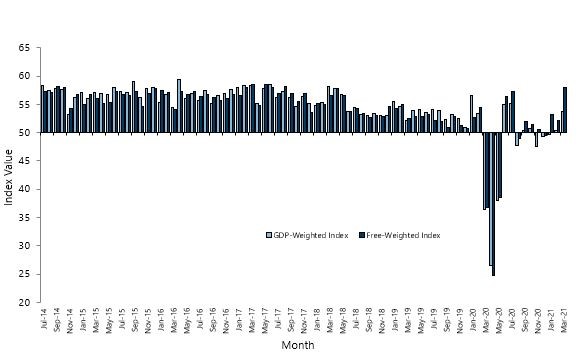

BNZ Senior Economist Craig Ebert said that “as decent as New Zealand’s PSI was for March, with its 52.4, it was shy of where the global PSI got to for the month, namely 54.7. Of course, it’s all relative to recent history, which for many countries abroad has meant a lift out of a hole rather than onto a podium”.