New Zealand’s services sector fell back in contraction during August, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

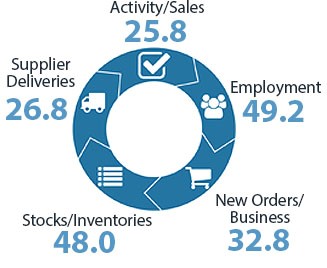

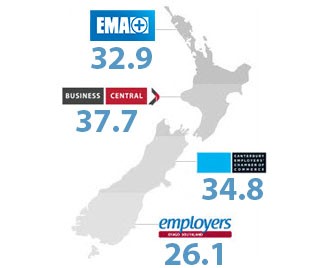

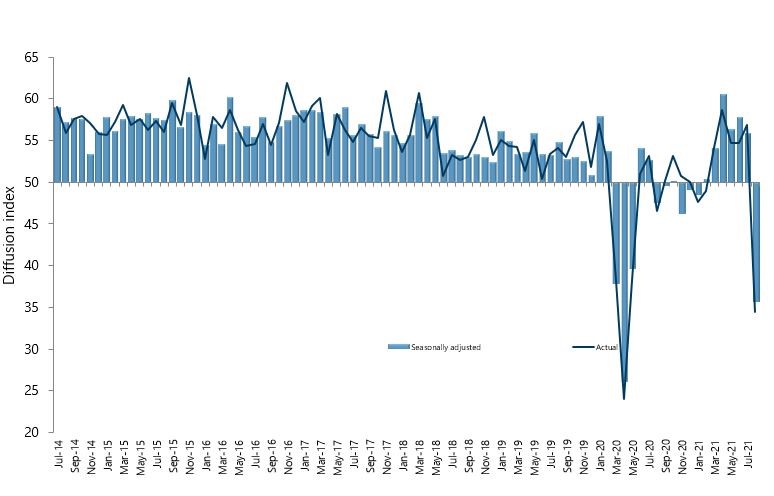

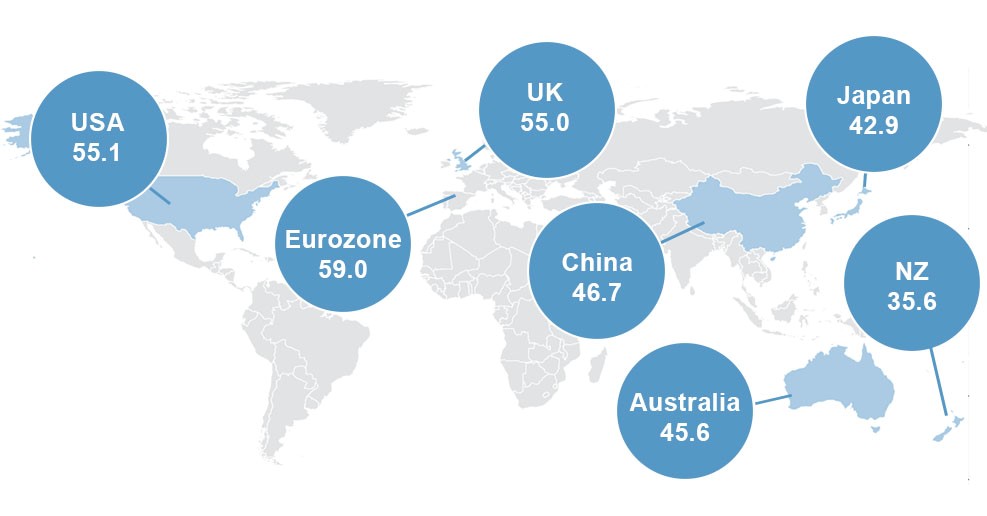

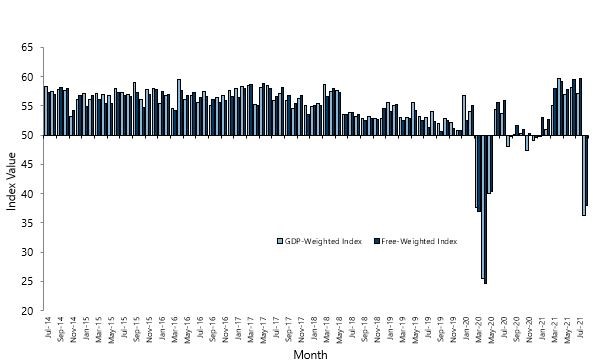

The PSI for August was 35.6 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was the second lowest level of activity since the survey began, with the April 2020 result still the lowest during the national lockdown last year.

BusinessNZ chief executive Kirk Hope said that like its sister survey the PMI, the national lockdown was the sole influencing factor causing service sector activity levels to plunge into contraction. Even for those outside Auckland moving down alert levels to resume business activity, there will be residual effects at least through September with both uncertainty and lower alert level restrictions playing their part.

BNZ Senior Economist Craig Ebert said that “while the August result wasn’t quite as bad as the 26.0 it plunged to in April 2020, the September 2021 result might be the better marker as the first half of August’s trading would have been solid, if July’s PSI result of 55.9 was any lead.”