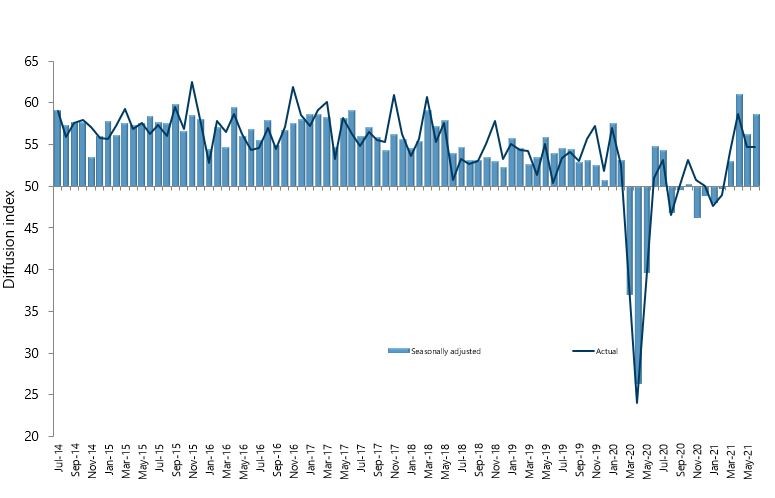

New Zealand’s services sector was in expansion mode for the fourth consecutive month, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for June was 58.6 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was 2.3 points up from May, but still below its highest ever result of 61.1 in April.

BusinessNZ chief executive Kirk Hope said that the sector experienced a boost in expansion after a lift in the key sub-indices of Activity/Sales (62.5) and New Orders/Business (66.1).

“While the key indicators show very healthy expansion, comments from respondents were very similar to its sister survey the PMI, highlighting staff/skills shortages and general logistics issues.”

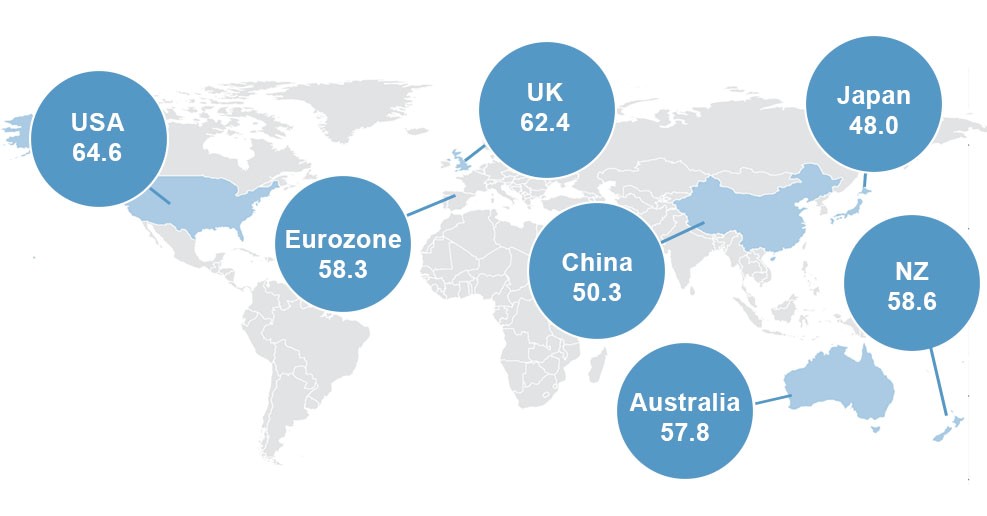

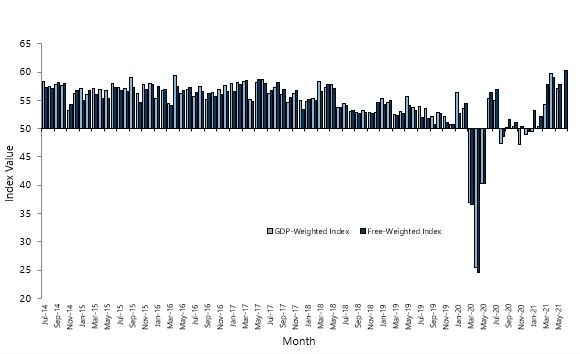

BNZ Senior Economist Craig Ebert said that “combined, the PSI and PMI signal a hefty rate of growth in economic activity – in the realm of a 4% annual rate of growth in GDP. At one level, this is very encouraging. At another, it suggests the economy is running headlong into even-worse capacity constraint, and, with it, serious inflation pressure.”