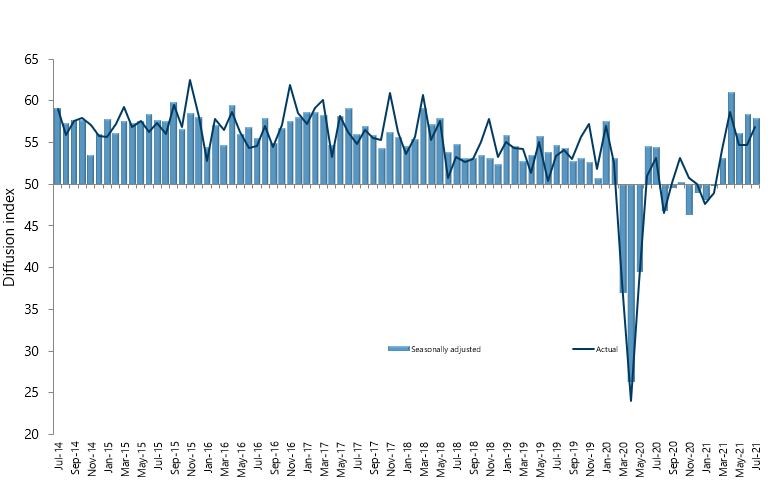

New Zealand’s services sector remained in expansion mode for the fifth consecutive month, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

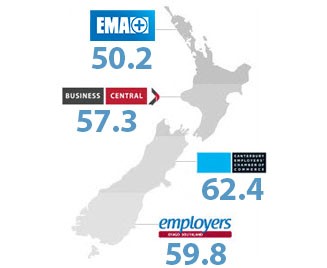

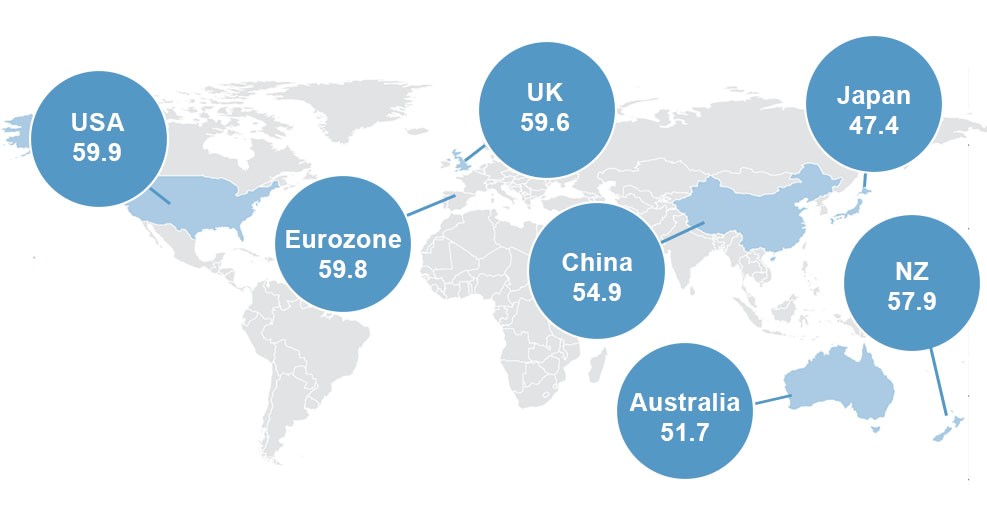

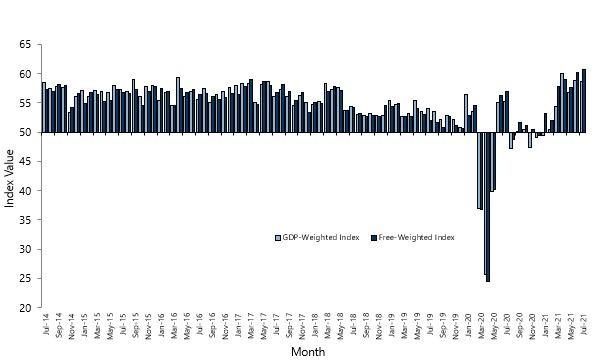

The PSI for July was 57.9 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). While this was down from 58.4 in June, it was still well above the overall average of 53.9 for the survey.

BusinessNZ chief executive Kirk Hope said that the sector will continue to show above average results as long as the key sub-indices of Activity/Sales (63.6) and New Orders/Business (63.2) remain strong. The one sub-index that remains in contraction is Supplier Deliveries (47.6), although the July result is at its highest level since July 2020.

BNZ Senior Economist Doug Steel said that “combined with last week’s blistering PMI employment reading of 58.3, it all sets up Q3 to be another strong quarter of employment growth and the nation’s unemployment rate continuing to press lower. This is good news if you are looking for a job, not so much if you are trying to find staff.”