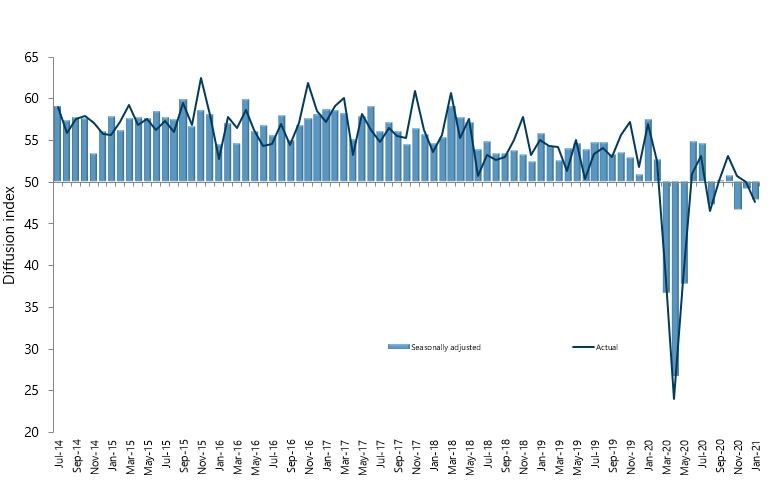

Activity in New Zealand’s services sector remained in contraction for a third consecutive month, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for January was 47.9, which was down 1.2 points from December (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was also well below the long term average of 53.8 for the survey.

BusinessNZ chief executive Kirk Hope said that the January result was generally negative when examined more deeply.

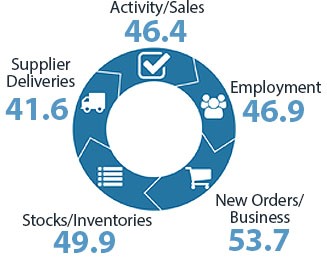

“While New Orders/Business (53.7) remained in expansion mode, the remaining sub-indices all displayed contraction, including Activity/Sales (46.4) and Employment (46.9). Looking at the comments made by respondents, the ongoing trend of contraction was typified by the influences of the Xmas period, ongoing COVID-19 related issues (including freight challenges) and a slower return to business as usual post holidays”.

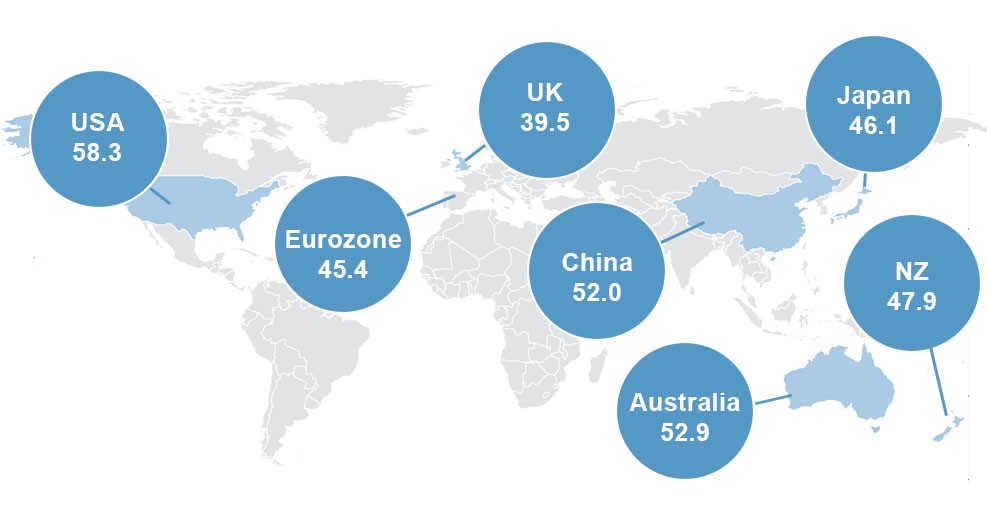

BNZ Senior Economist Doug Steel said that “combining last week’s very strong PMI with today’s soft PSI points to some slowing in growth. But we also need to factor in strong public sector jobs growth and a booming construction sector”.