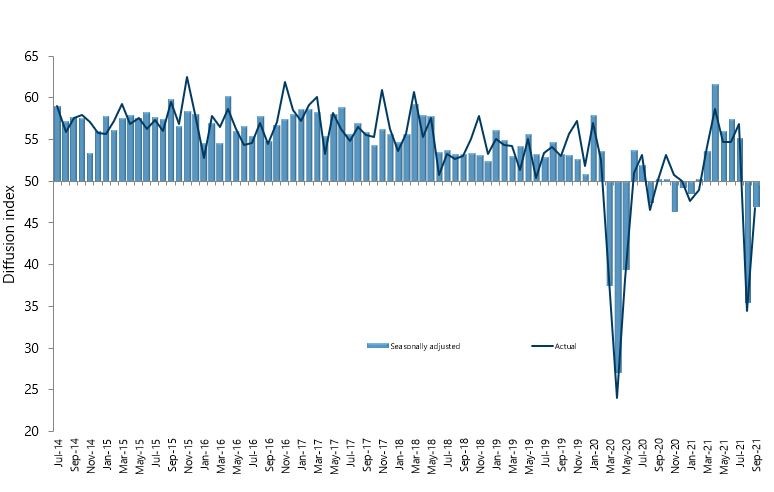

New Zealand’s services sector remained in contraction during September, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

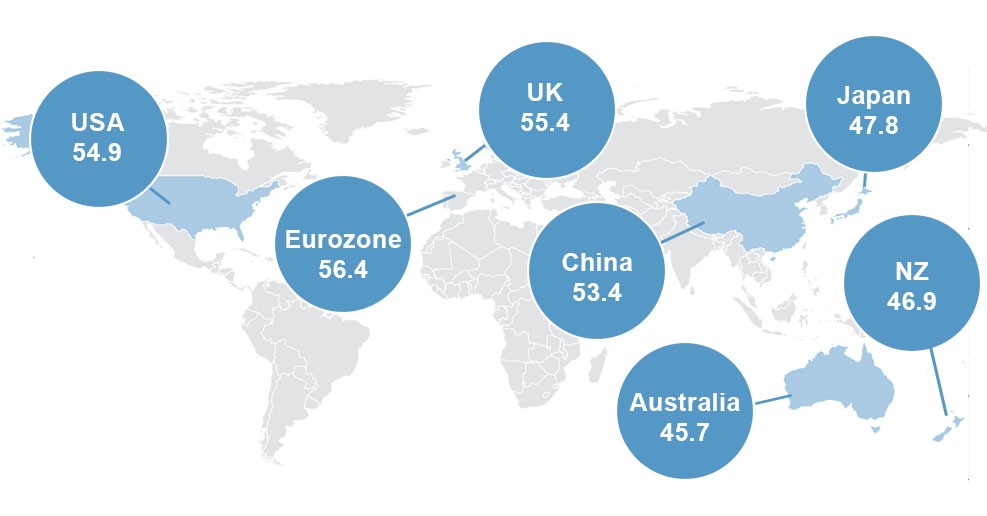

The PSI for September was 46.9 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was up 11.5 points from August as the country moved down alert levels during September, freeing up some businesses for increased activity.

BusinessNZ chief executive Kirk Hope said that despite the improvement in the overall result for September, current restrictions still mean business as usual for most of the country is still a ways off yet.

“COVID-19 and its associated lockdown/restrictions still completely dominate comments from respondents, while the key sub-indexes of Activity/Sales (45.3) and New Orders/Business (47.5) remain in contraction. At what point the PSI returns to expansion will largely depend on any upcoming changes to alert levels in the weeks ahead.”

BNZ Senior Economist Doug Steel said that “subdued new orders warn against expecting too much of a bounce in coming months. Of course, the spread of COVID, vaccination rates, and any restriction changes will have a very large bearing on that.”