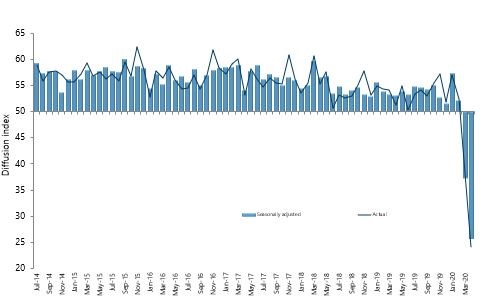

Activity in New Zealand’s services sector ground to a halt during April, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

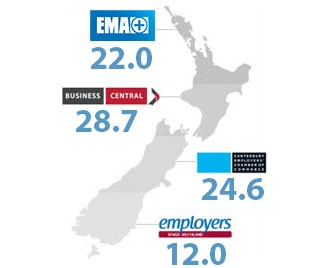

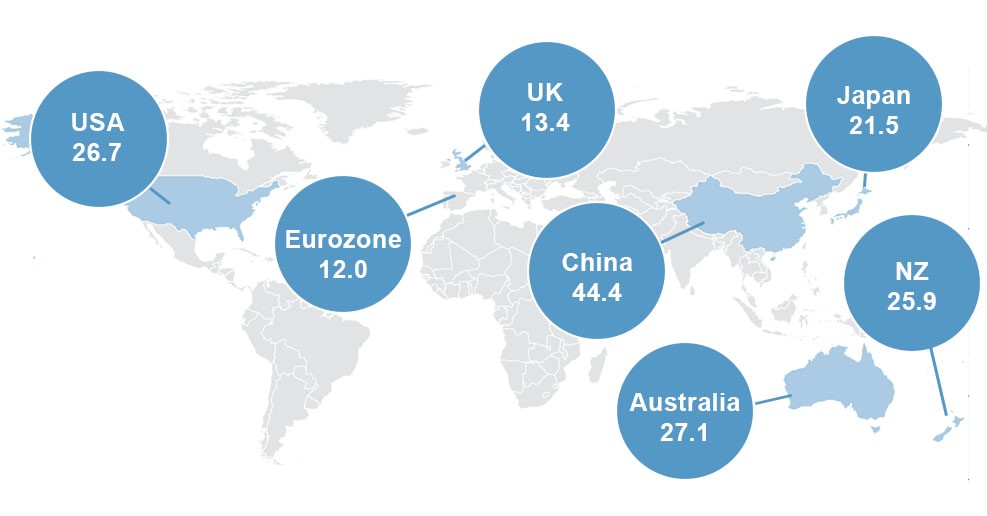

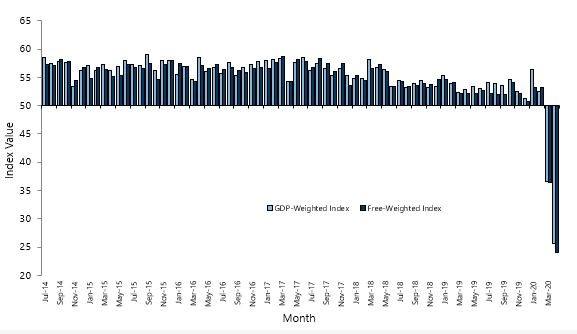

The PSI for April was 25.9, which was 11.4 points down from March* (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). The April result was also the lowest level of activity since the survey began in 2007.

BusinessNZ chief executive Kirk Hope said that like its sister survey the PMI, the almost total lockdown of the country at level 4 meant most businesses were either significantly affected, or simply couldn’t trade at all during April.

“The proportion of negative comments for April stood at 91%, with COVID-19 the key word used throughout. Given the move to level 2 last week for most businesses, a return to higher levels of activity is expected looking forward. However, the social distancing restrictions that remain in place will still provide a brake for many.”

BNZ Senior Economist Craig Ebert said that “a sizable rate of contraction is what you get when businesses are forbidden from operating, especially those with a customer-facing focus. Covid-19 has seen to that, with policy responses reinforcing the sudden stop”.

*Due to not running the March 2020 PSI because of COVID-19, the March figures have been obtained by taking an average of both the actual combined February 2020 and April 2020 values. The results have then been seasonally adjusted.