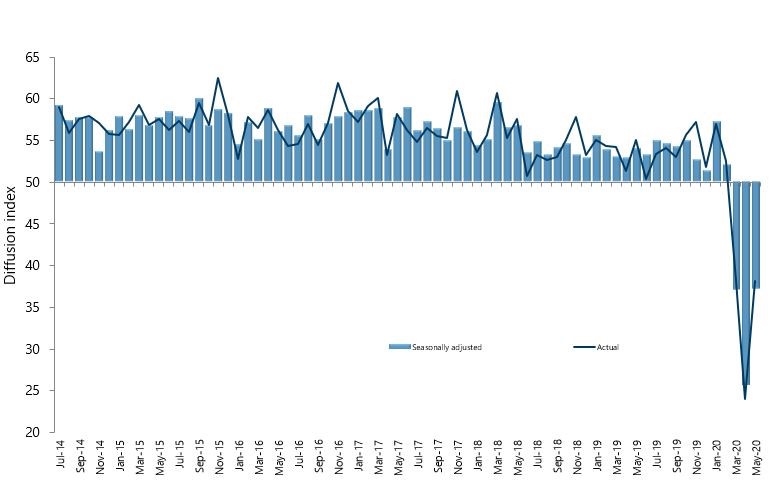

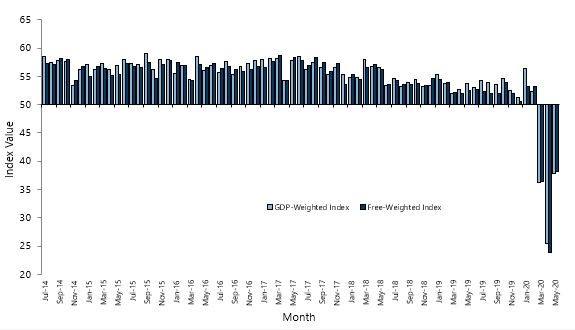

Activity in New Zealand’s services sector improved somewhat for May after its lowest ever result in April, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

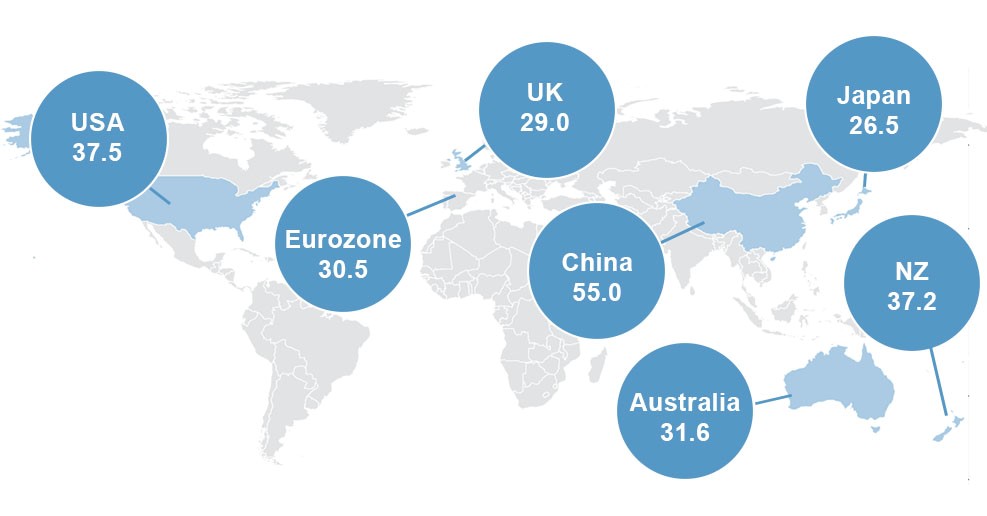

The PSI for May was 37.2, which was 11.5 points up from April (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was just above the March result, but still showing strong contraction for the month.

BusinessNZ chief executive Kirk Hope said that the result for May was similar to that of the manufacturing sector, with improvements made but still well below anything considered business as usual.

“The proportion of negative comments for May (72.9%) did drop from 91% in April. Looking ahead, around two-thirds of June will be at level 1, so we would expect ongoing improvements in activity in the months ahead”.

BNZ Senior Economist Doug Steel said that “we’d caution that just being allowed to open doesn’t guarantee more activity. Standing back, there is no denying the outright level of the PSI remains woeful and still sits well below the lows at around 45 recorded during the 2008/09 recession”.