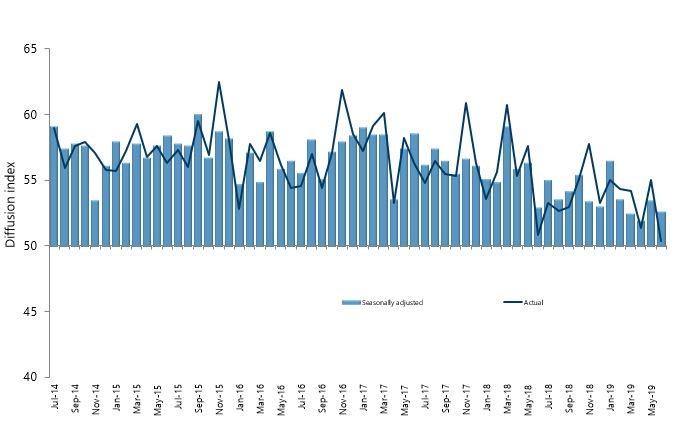

Activity in New Zealand’s services sector softened in June, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for June was 52.7, which was 0.8 points down from May, and close to activity levels last seen in March (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). The June result remained below the long term average of 54.4 for the survey.

BusinessNZ chief executive Kirk Hope said that the pick-up in May couldn’t be sustained, and symptomatic of a lacklustre first half of 2019 for the sector.

“The first 6 months of 2019 represented the lowest overall average activity result for that timeframe since late 2012/early 2013. While the index has yet to get very close to the no change mark of 50, nor has it shown any signs of building momentum to pick up pace.

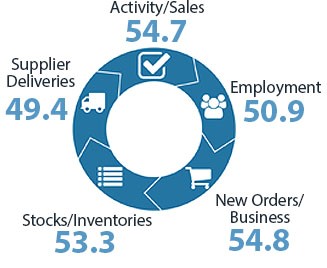

“New orders/business (54.8) continued it slowly slide to its lowest level since September 2012. Employment (50.9) has managed to again only just keep its head above water, while supplier deliveries (49.4) again fell back into contraction.

Looking at comments from respondents, the proportion of positive comments for June (49.0%) took a hit from May (56.6%), although not as low as April (43.9%).

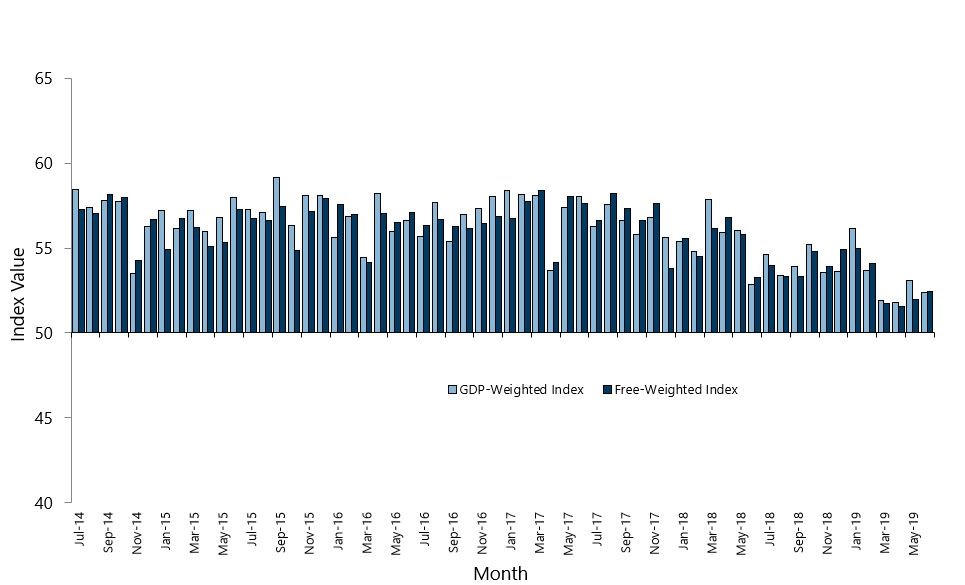

BNZ Senior Economist Craig Ebert said that “the PSI still paints a picture of slow-running GDP growth for the meantime. This is reinforced by New Zealand’s PMI having dipped below trend over recent months too”.