Activity in New Zealand’s services sector slipped further during April, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

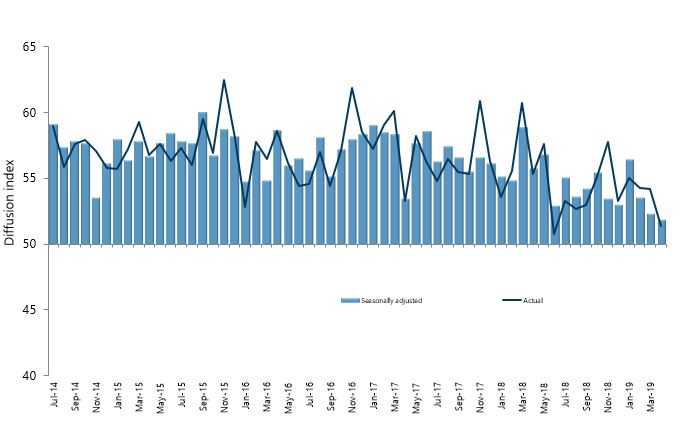

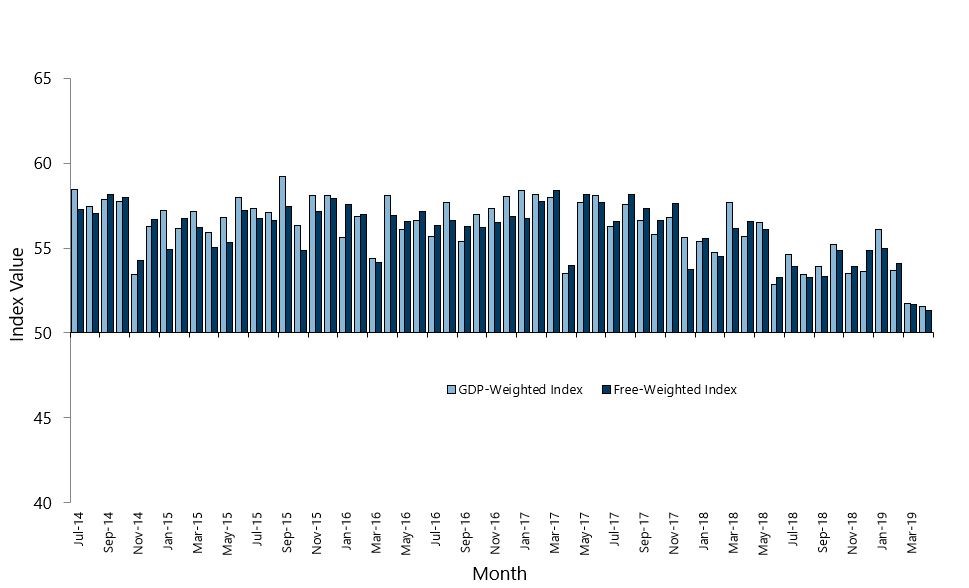

The PSI for April was 51.8, which was 0.5 points down from March, and the third consecutive month-on-month decrease in expansion levels (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). The April result was the lowest since September 2012, and below the long term average of 54.4 for the survey.

BusinessNZ chief executive Kirk Hope said that the ongoing decline in expansion is a concern, exacerbated by a few factors during April

“The proportion of positive comments for April (43.9%) decreased significantly from March (55.8%). The decline was partly due to a number of comments centred on the ANZAC/Easter break disrupting usual business activity. Others noted a general economic downturn and slowing demand”.

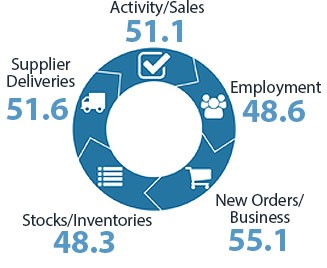

In terms of the sub-index values for April, activity/sales (51.1) was at its lowest point since July 2012, while employment (48.6) dropped to its lowest point since August 2012. New orders/business (55.1) bucked the trend slightly, increasing marginally from 54.9 in March.

BNZ Senior Economist Craig Ebert said that “unless there is a sizable bounce in May’s PSI, we’ll be left with the distinct impression of a slowing services sector”.