New Zealand’s services sector returned to expansion levels seen during the start of the year, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

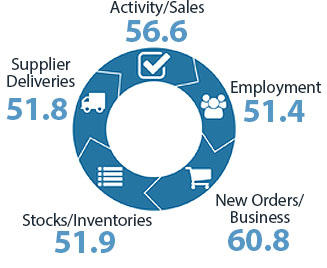

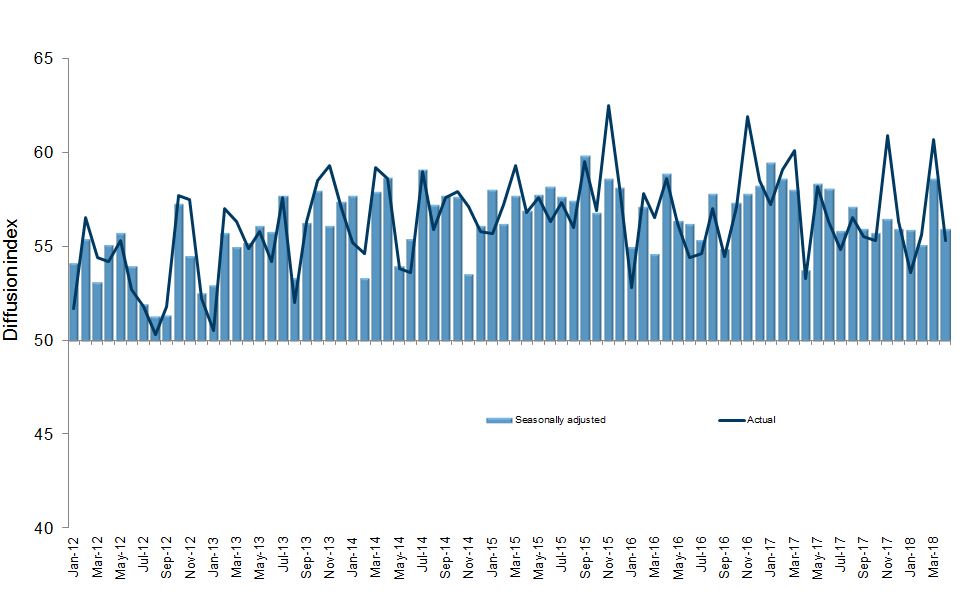

The PSI for April was 55.9, which was 2.7 points lower than March (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). It was the third time in the last five months that an expansion result of 55.9 has been reached.

BusinessNZ chief executive Kirk Hope said that while the April results showed a decrease in expansion levels, the April result was still very consistent with recent values.

“Comments clearly remain more positive (65.1%) than negative, with many stating business as usual, as well as various seasonal factors at work. Overall, the sector remains in good heart”.

BNZ Senior Economist Craig Ebert said that “even with its big fall in April, the PSI remained better than average. The long-term average for the series is 54.5. Outside of March’s spike, the PSI has been averaging just-above normal post the announcement of the new government”.