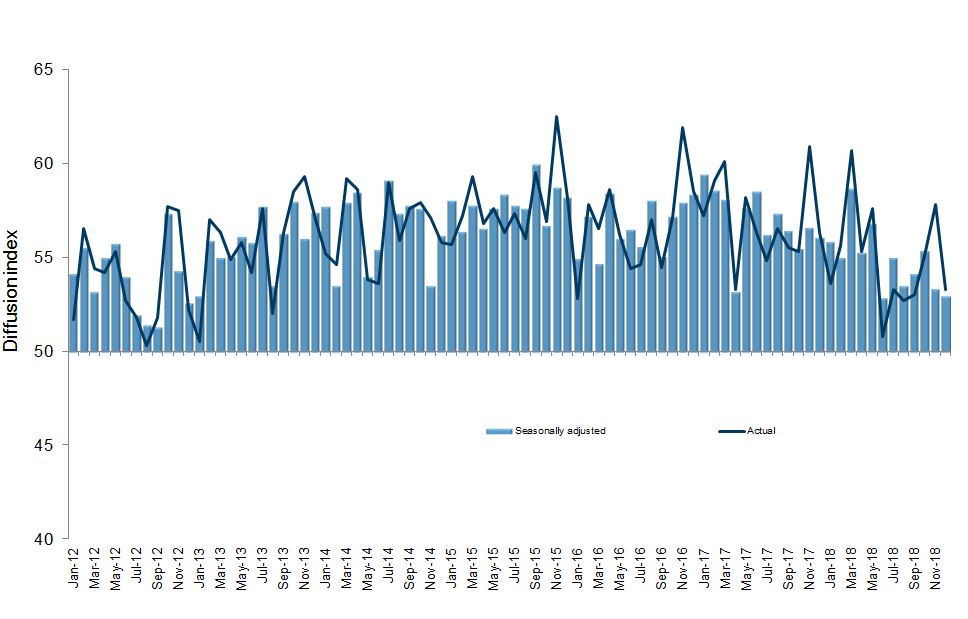

New Zealand’s services sector experienced a further dip in expansion levels during December, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

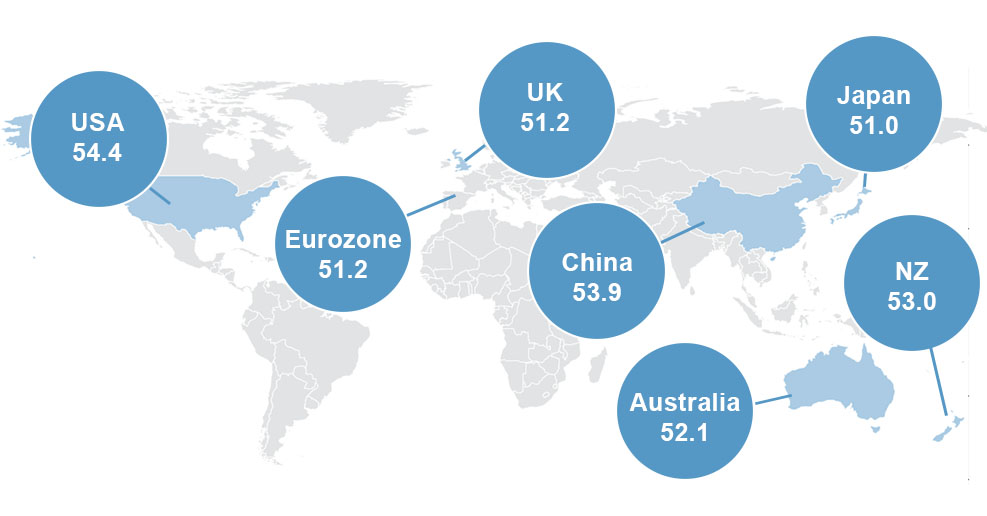

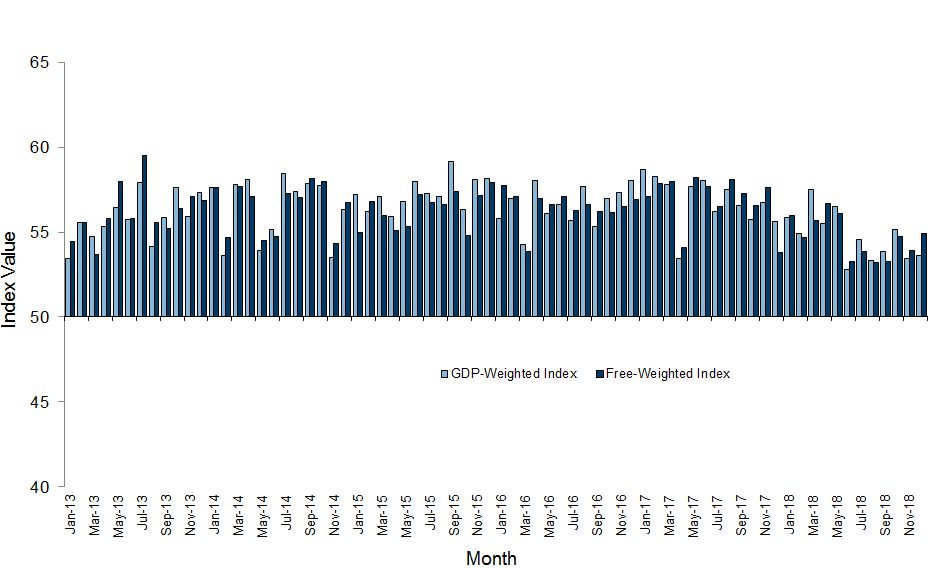

The PSI for December was 53.0, which was 0.4 points down from November (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was the lowest level of expansion since June, and meant the overall average rate for 2018 was 54.9. This was lower than 2016/2017, but still slightly ahead of the long term average of 54.5 for the survey.

BusinessNZ chief executive Kirk Hope said that the December result was influenced by a few factors.

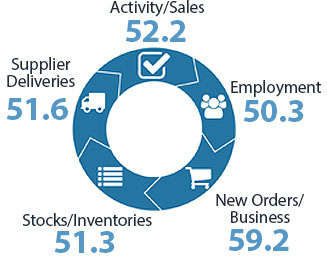

“Despite the sub-index of new orders (59.2) improving from November, the other key sub-index of activity/sales (52.2) continued to drop, reaching its lowest level of expansion since May 2014. Employment (50.3) returned to levels experienced for a sizeable part of 2018, while supplier deliveries (51.6) returned to expansion.

The further dip in expansion also saw a drop in positive comments received, with the proportion of positive comments in December (54.4%) lower than both November (60.1%) and October (56.5%). Both Xmas and holidays were the stand out reason for negative comments, although a number of positive comments also focused in this space”.

BNZ Senior Economist Doug Steel said that the recent PSI results “adds to the sense that growth in the service sector has been slower over the past six months. But it is also important to recognise that it appears to be stabilising at this slower pace rather than slowing further”.