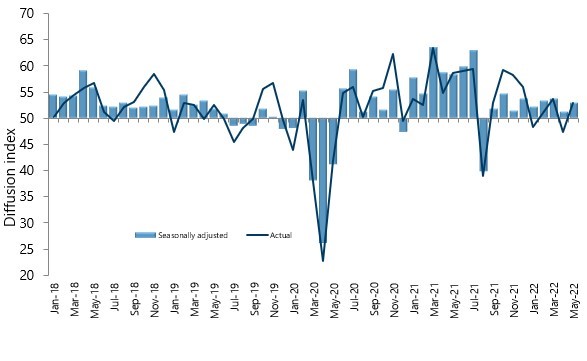

New Zealand’s manufacturing sector remained under its long-term average level of activity for May, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

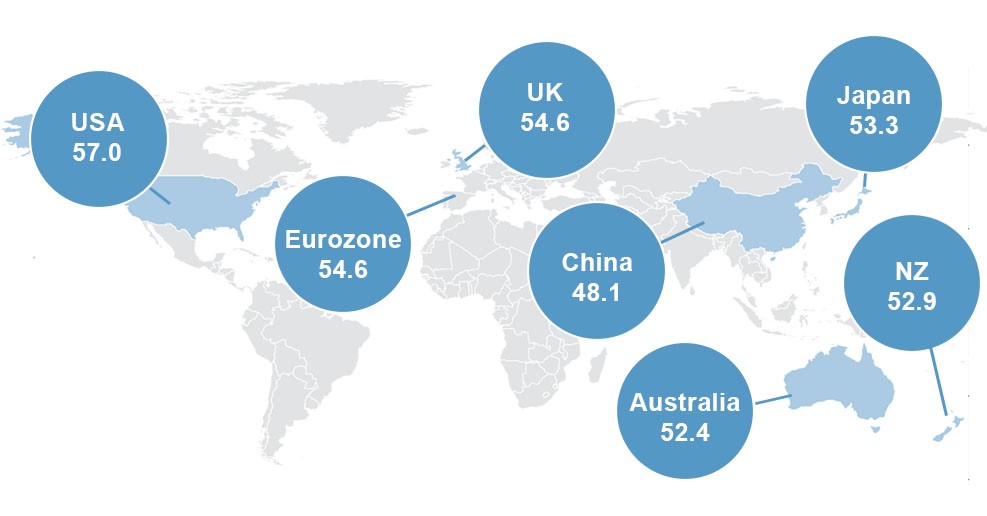

The seasonally adjusted PMI for May was 52.9 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). While this was 1.7 points higher than April, it was still below the long-term average of 53.1 for the survey.

BusinessNZ’s Director, Advocacy Catherine Beard said that the pick-up in activity for May continued the recent trend of results where activity remains within a relatively narrow band of expansion.

“While both Production (52.8) and Delivery of Raw Materials (55.4) both managed to return to expansion for May, the other key sub-index of New Orders (53.0) recorded its lowest level of activity since the August lockdown in 2021. Overall, any sustained move towards historical levels of expansion requires a healthy level of new orders, which has averaged 55.0 since the survey began.”

Manufacturers continue to have a more negative mindset during May, with the proportion of negative comments at 72.7%, compared with 70.3 in April and 64.2% in March. While COVID and related issues remain a key influence, skill/labour shortages are also regularly mentioned.

BNZ Senior Economist, Craig Ebert stated that “The net result of the sub-index values was the inference that excess demand alleviated during May. New orders are perhaps the cleanest representation of demand, while deliveries speak more to the supply side. To the extent excess demand is abating, so too will be core inflation pressure”.