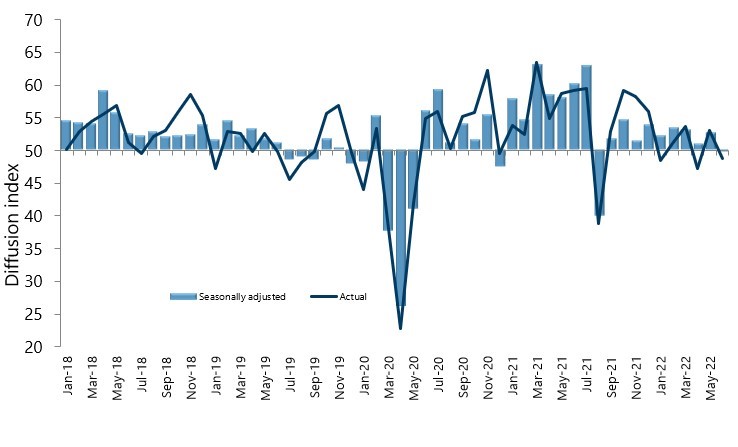

New Zealand’s manufacturing sector fell back into contraction for the first time since the most recent national lock-down in August 2021, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

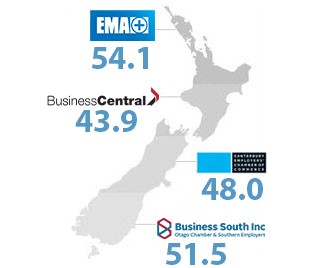

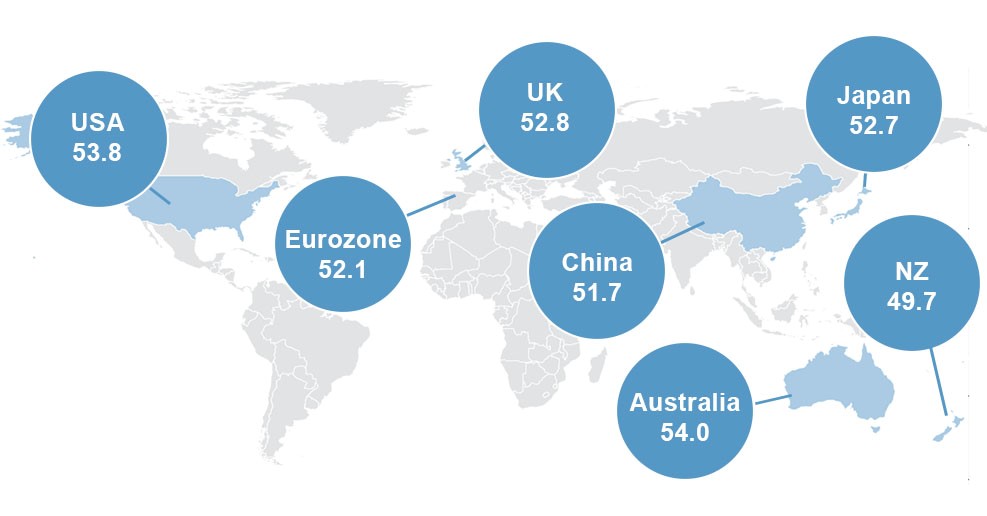

The seasonally adjusted PMI for June was 49.7 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 2.9 points lower than May, and well below the long-term average of 53.1 for the survey.

BusinessNZ’s Director, Advocacy Catherine Beard said that the drop in activity levels for June highlights the fact that the sector remains in struggle street to get back to long-term activity levels.

“The key sub index values of Production (47.8) and New Orders (47.8) both recorded the same level of contraction, which had a combined negative effect on the overall Index. As mentioned in previous months, a strong and consistent activity level for both these key sub index values will be the only way to push the PMI towards better results.”

Manufacturers continue to have a more negative mindset, with the June result showing 68.5% provided negative comments. While this was down from 72.7% in May and 70.3% in April, staff retention/shortages continue to plague the sector, as does supply chain issues.

BNZ Senior Economist, Doug Steel stated that “June’s weak PMI adds a note of caution and certainly supports our broader concern about economic growth ahead”.