New Zealand’s manufacturing sector saw an overall return to expansion for September, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

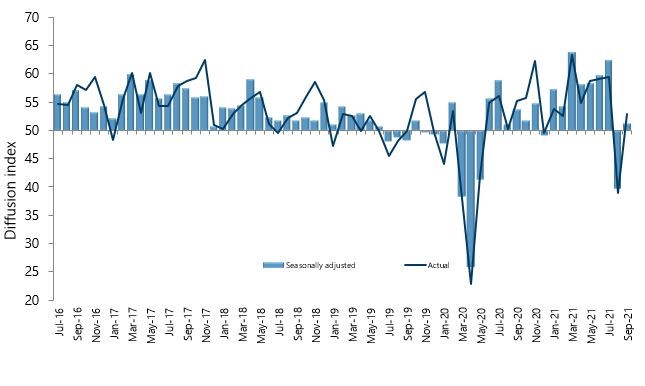

The seasonally adjusted PMI for September was 51.4 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 11.7 points higher than August, but still someway off levels of expansion typically seen pre-lockdown.

BusinessNZ’s executive director for manufacturing Catherine Beard said that while the positive national result for September was encouraging, it masked a few underlying issues.

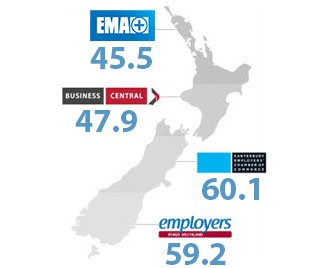

“Prior to the lockdown, the PMI averaged close to 60 since the start of 2021, which means expansion has some way to go before getting back to what was seen during the first half of the year. Also, there is currently a clear difference between the two islands with the North Island still in contraction, while the South Island has swiftly returned to levels of expansion seen pre-August.”

“In addition, the proportion of negative comments from respondents remains high at 71%, although slightly down from the 78% recorded in August.”

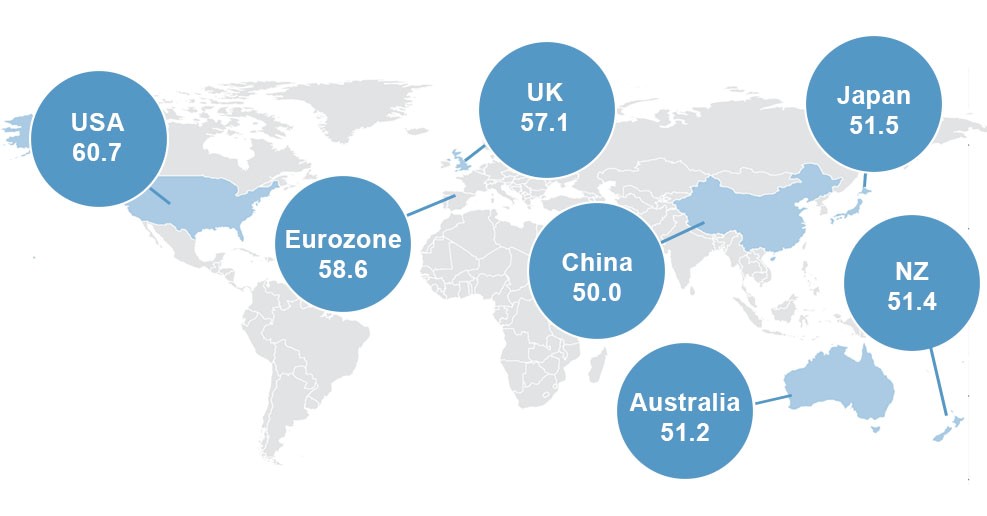

BNZ Senior Economist, Craig Ebert stated that “the rebound the PMI experienced in September was encouraging, although the survey is not without some still‐frayed parts. Credit where it’s due though, as the NZ PMI traced much less of a contraction, and quicker stabilisation, compared to what it went through during the initial outbreak of COVID‐19.”