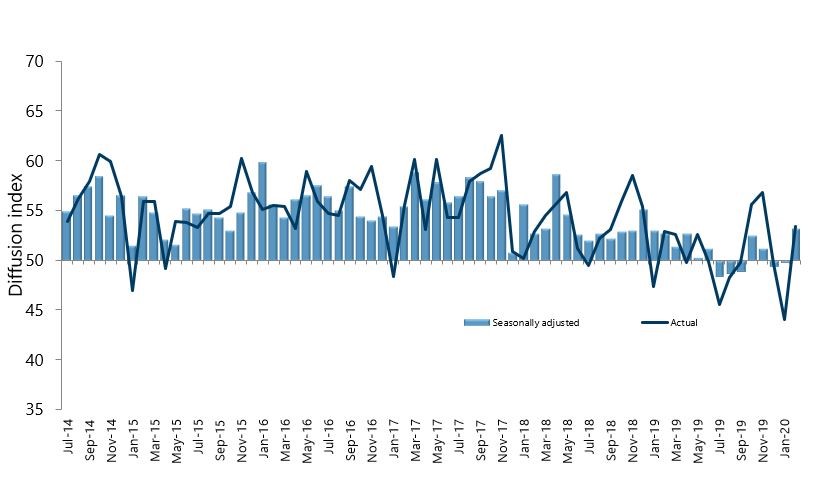

New Zealand’s manufacturing sector experienced expansion for the first time in three months, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

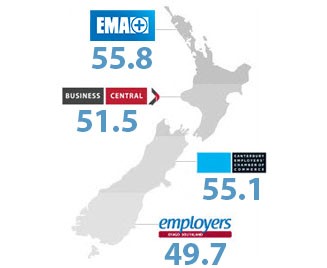

The seasonally adjusted PMI for February was 53.2 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was up 3.4 points from January.

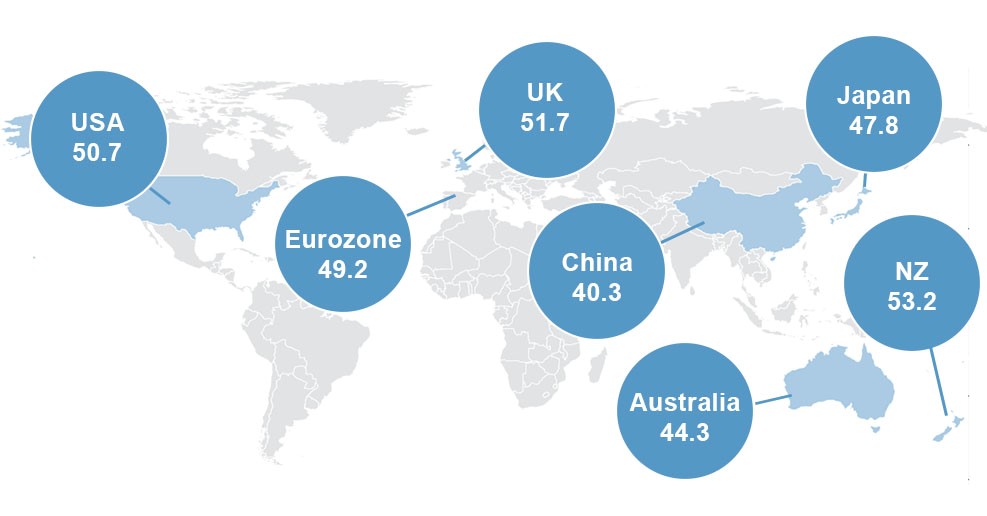

BusinessNZ’s executive director for manufacturing Catherine Beard said that despite the positive February result, much focus will be on the coming months given the effect Covid-19 is having on the global economy.

“Looking at comments from respondents, there was a noticeable increase in Covid-19 being mentioned, either directly or through the impact on shipping from China. Even those who made positive comments tempered it with concerns about the months ahead”.

“While the sector has not been hit hard by Covid-19 as yet, offshore experiences show how rapidly the situation can change, especially for those manufacturers who source materials offshore and cater for particular markets”.

BNZ Senior Economist, Craig Ebert said that “The most encouraging aspect of the PMI – considering the global ructions beginning to emerge in February – was arguably its new orders. These gained to 55.3, from 50.9 in January. And with widespread reports of supply-chain disruptions around the world, it was also interesting to see the PMI’s Deliveries of Raw Materials index had picked up to 53.1, from 47.7″.