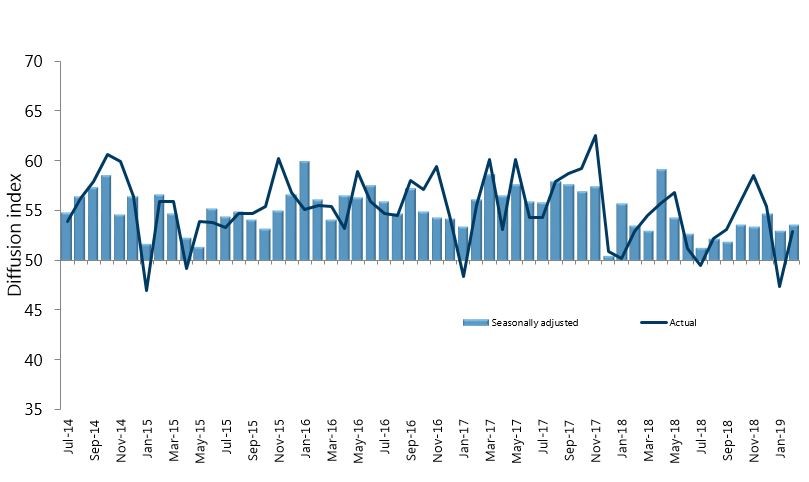

New Zealand’s manufacturing sector experienced a slightly improved level of expansion for February, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

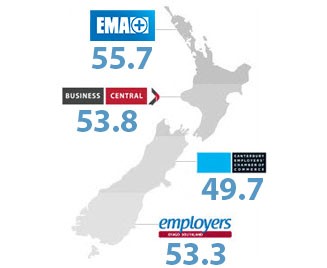

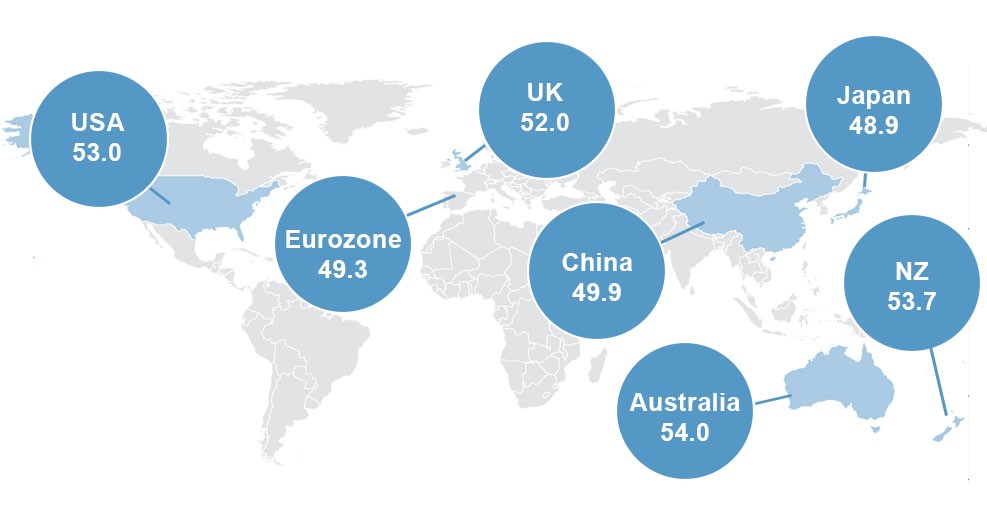

The seasonally adjusted PMI for February was 53.7 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 0.7 points up from January, and the second highest expansion level for the last nine months.

BusinessNZ’s executive director for manufacturing Catherine Beard said that overall, February was a stable month for the sector.

Looking at the main sub-index values, both production (53.9) and new orders (54.7) showed a part recovery after a noticeable drop in expansion levels during January. However, employment (50.8) dropped a further 1.2 points to its lowest level since August 2018.

The slight improvement in February’s results also meant the proportion of positive comments for February (51.1%) was up on January (47.7%), but still down from December (60.6%) and November (60.1%). Seasonal factors were still evident throughout the comments, although a number of respondents felt that February was business as usual.

BNZ Senior Economist, Craig Ebert said that “While the PMI remains broadly encouraging, inventory dynamics bear watching – in case they forewarn of a slower tone to manufacturing production ahead.”