New Zealand’s manufacturing sector experienced a lower level of expansion for the first month of 2019, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

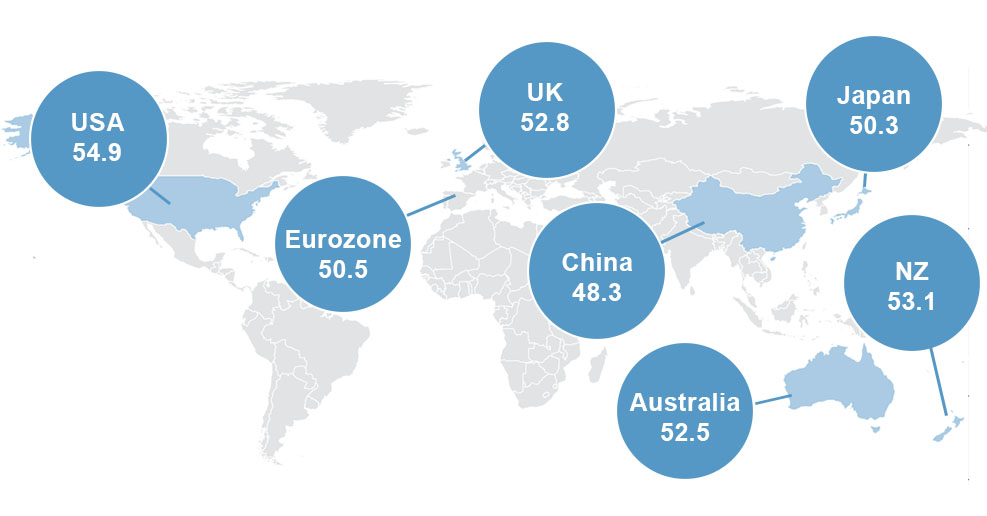

The seasonally adjusted PMI for January was 53.1 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 1.7 points down from December, and below the long term average of 53.4 for the survey.

BusinessNZ’s executive director for manufacturing Catherine Beard said that while the January result looked fairly similar to the results in 2018, there were aspects of it that will need to be watched in future months.

Looking at the main sub-index values, new orders (52.2) decreased its level of expansion for a third consecutive month, with the latest result the lowest since December 2017.

In addition, the proportion of positive comments for January (47.7%) was down considerably from December (60.6%) and November (60.1%). However, seasonal factors such as Christmas and summer holidays were evident throughout the comments. There were also a number who mentioned a softening of customer orders and market conditions.

BNZ Senior Economist, Doug Steel said that “looking beyond the steady headline reading, the details of this month’s survey do raise some questions about the durability and pace of the current expansion”.