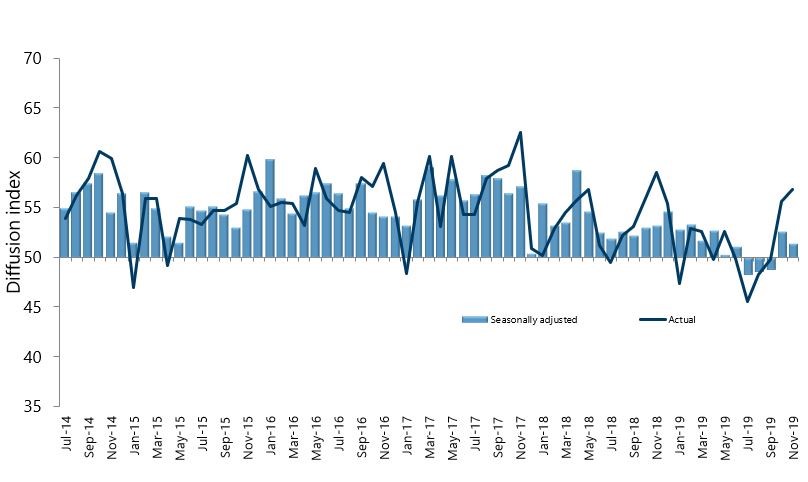

New Zealand’s manufacturing sector experienced slower expansion levels in November, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

The seasonally adjusted PMI for November was 51.4 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). While this was the second consecutive month in expansion, it was 1.2 points lower than October’s value.

BusinessNZ’s executive director for manufacturing Catherine Beard said that the November result was somewhat of a mixed bag.

“The sub-index of new orders (54.5) continued to lead the charge in terms of displaying the highest level of expansion. However, production (49.6) fell back into slight contraction, as did employment (49.2). Finished stocks (48.6) remained in a fairly tight band of contraction, while deliveries of raw materials (52.8) continued to improve from the previous month.

“The fact that new orders remains relatively healthy should provide further impetus for the sector in the coming months. However, a sustained level of activity above the long term average for new orders would help get the sector as a whole back on track.

Despite the dip in expansion, the proportion of positive comments for November (65.3%) was higher than October (57.6%) and September (48.8%). Seasonal factors such as Xmas was a common theme in comments, as well as more offshore demand.

BNZ Senior Economist, Doug Steel said that “If October’s big lift in the PMI suggested the worst of NZ’s economic slowdown was behind us, November’s consolidation suggests any acceleration is not going to be in a straight line”.