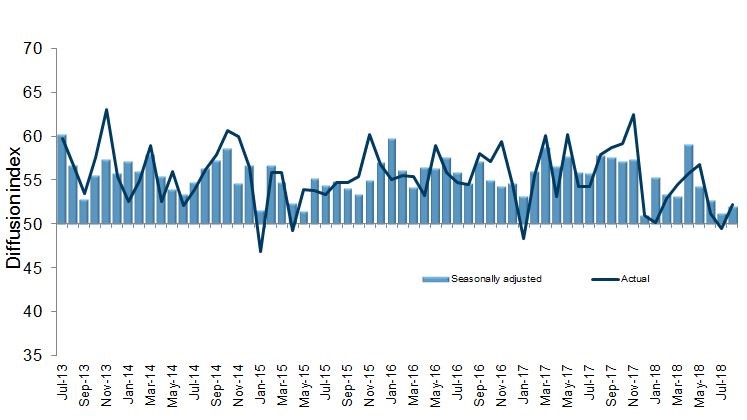

New Zealand’s manufacturing expansion remained in low gear for the third consecutive month, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

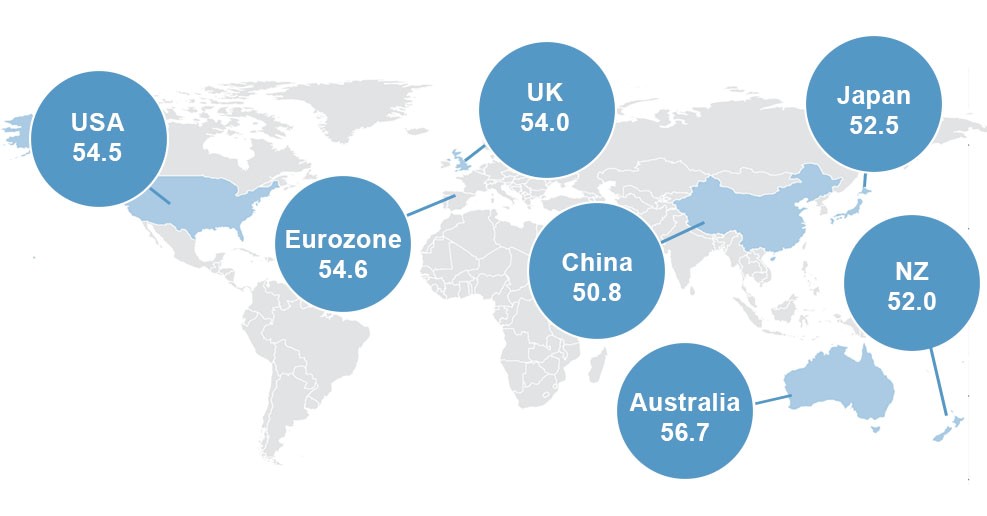

The seasonally adjusted PMI for August was 52.0 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). While this was 0.8 points higher than July, it remains below the long run average expansion level of 53.4.

BusinessNZ’s executive director for manufacturing Catherine Beard said that in a similar vein to July, the August results were a mixed bag.

“While production (52.6) returned to expansion and new orders (53.2) also improved from July, employment (48.1) fell back into contraction to its lowest level since August 2016. Looking at the remaining sub-indices, deliveries (54.3) remained largely unchanged, while finished stocks (51.4) decreased 2.1 points.

The proportion of positive comments (56.3%) lifted in August, with construction demand noted by a number of respondents. Those who outlined negative influences typically focussed on a general slowing of market conditions and customer demand”.

BNZ Senior Economist, Craig Ebert said that “although the PMI improved in August, this was hardly different to the average of the previous two months, leaving the PMI running below normal in its growth signal”.