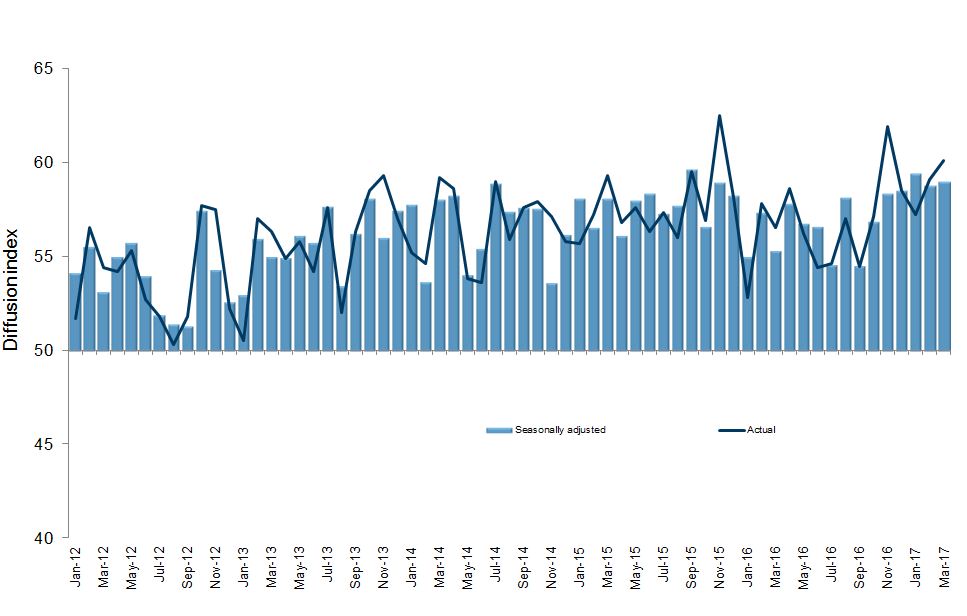

New Zealand’s services sector experienced a sudden drop in expansion levels during April, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

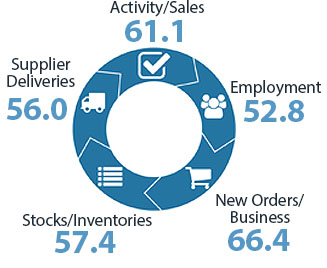

The PSI for April was 52.8. This was 6.0 points lower than March, and the lowest level of expansion since December 2012 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining).

BusinessNZ chief executive Kirk Hope said that the drop in expansion levels compared with recent months was most likely due to a number of factors affecting the business community in recent weeks.

“Looking at comments from respondents, it was fairly evident that school holidays, public holidays and severe weather conditions combined to create a number of impediments to expansion during April.”

“Looking ahead, with new orders (55.6) still in healthy territory, we would hope that expansion picks up again in the months ahead”.

BNZ Senior Economist Doug Steel said that “if there is a slowing in underlying economic momentum underway, the drop in the PSI surely overstates it. That said, it will be good to see a decent bounce back in May to confirm that is indeed the case”.